Are you seeking to enhance the effectiveness of your savings? A **high-yield savings account (HYSA)** may serve as a suitable solution. These accounts provide more favorable **interest rates** compared to traditional savings alternatives, thereby enabling your funds to generate greater returns. This article aims to define what constitutes a **high-yield savings account**, examine the **key factors to consider** when selecting one, and present a ranking of the **top five accounts** for Spring 2025. Furthermore, it offers a **step-by-step guide** on how to open an account and includes **strategies to maximize your savings**. Explore the information provided to understand how to optimize your financial resources.

What is a High-Yield Savings Account?

A high-yield savings account is a specific type of deposit account that generally provides substantially higher interest rates, referred to as the annual percentage yield (APY), compared to traditional savings accounts.

These accounts are designed to assist individuals in achieving their financial objectives by offering a secure and accessible means to grow their savings, with the assurance that funds are protected under deposit insurance, particularly through FDIC-insured institutions.

As of Spring 2025, numerous online banks and financial institutions are actively competing to provide some of the most advantageous savings accounts available, catering to consumers who seek higher returns on their deposits.

Definition and Benefits of High-Yield Savings Accounts

High-yield savings accounts represent a robust option for individuals seeking to safeguard their savings while earning higher interest rates compared to standard accounts. These accounts are particularly beneficial for achieving financial objectives such as building an emergency fund, ensuring financial stability, or saving for future investments.

Typically, high-yield savings accounts offer competitive annual percentage yields (APYs) that can substantially surpass inflation rates, thereby facilitating wealth accumulation over time. The liquidity provided by these accounts enables individuals to access their funds as needed without incurring penalties, making them an essential component of a comprehensive financial strategy, including both short-term savings and long-term savings.

In comparison to traditional savings options, high-yield savings accounts not only enhance growth potential but also provide a degree of safety and flexibility that is critical during unforeseen circumstances. By evaluating different high-yield accounts, individuals can identify the most favorable terms and conditions that align with their financial situation, thereby optimizing their savings journey.

Factors to Consider When Choosing a High-Yield Savings Account

When selecting a high-yield savings account, it is imperative to evaluate several factors that can substantially affect the growth of your savings, including interest rates, fees, minimum deposit, and account accessibility.

Various financial institutions may present differing Annual Percentage Yields (APYs) and account features, underscoring the importance of conducting comprehensive research and diligent account management to identify the most suitable option that aligns with your financial objectives.

Furthermore, customer reviews can offer valuable insights into the user experience and the reliability of the banks under consideration.

Interest Rates, Fees, and Accessibility

Understanding the nuances of interest rates, fees, and account accessibility is essential when evaluating high-yield savings accounts, as these factors directly influence savings efficiency and overall user satisfaction.

Different financial products often feature varying interest rates, which can have a significant impact on the growth of savings over time. The presence of fees—such as maintenance charges, withdrawal limits, or transaction fees—can diminish potential earnings, making it imperative for users to carefully review the terms and conditions.

Online banks may provide distinct advantages, including mobile banking access, higher interest rates, and the absence of minimum balance requirements, which can enhance the overall user experience and account accessibility.

When considering these aspects, it is crucial for individuals to assess the advantages of higher yields against potential costs and to ensure they have convenient access to their funds. This approach ultimately contributes to a more satisfying financial journey.

Top 5 High-Yield Savings Accounts for Spring 2025

As of Spring 2025, the landscape for high-yield savings accounts has become increasingly competitive, with numerous financial institutions striving to attract customers through the provision of appealing interest rates, distinctive account features, and enticing promotional offers.

Conducting a comprehensive comparison of savings accounts enables consumers to identify the most advantageous options for optimizing their savings growth, taking into consideration various factors such as annual percentage yield (APY), associated fees, and account terms.

High-Yield Savings Account Rates 2025

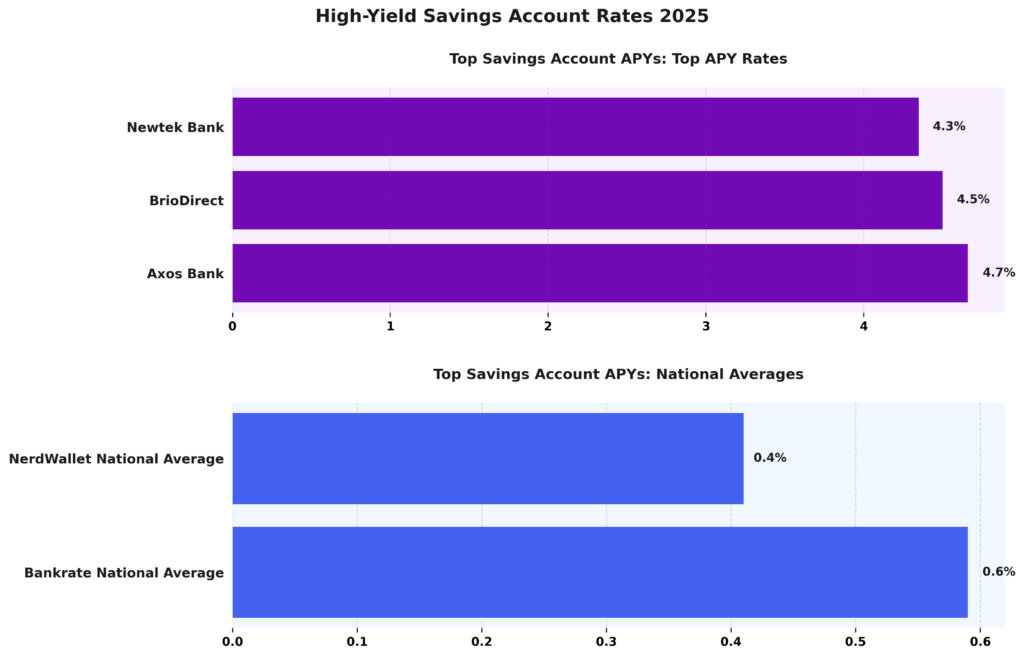

The High-Yield Savings Account Rates 2025 data provides a snapshot of the top annual percentage yields (APYs) offered by various banks and the national average rates. This market comparison highlights the significant advantages of choosing high-yield accounts over standard savings accounts.

Top Savings Account APYs showcase the best rates available in the market:

- Axos Bank offers the highest APY at 4.66%, making it an attractive option for those looking to maximize their savings returns.

- BrioDirect follows closely with a 4.5% APY, providing another excellent choice for high-yield savings.

- Newtek Bank offers a competitive 4.35% APY, rounding out the top three options.

In contrast, the National Averages for savings account rates are significantly lower:

- The Bankrate National Average stands at 0.59%, which is considerably less than the top high-yield options.

- The NerdWallet National Average is even lower at 0.41%, highlighting the disparity between typical savings accounts and high-yield alternatives.

This data underscores the importance of comparing savings account options to ensure maximum returns. High-yield savings accounts, like those offered by Axos Bank, BrioDirect, and Newtek Bank, provide significantly better growth potential for your savings compared to the national averages. Choosing a high-yield savings account can make a substantial difference in the interest earned over time, especially when compared to the lower rates commonly offered by traditional banks and money market accounts.

Overall, the High-Yield Savings Account Rates 2025 data demonstrates the advantages of seeking out the best available rates. By opting for high-yield savings accounts, consumers can take advantage of the superior APYs, leading to more substantial financial growth and better returns on their savings.

Features and Comparison of High-Yield Savings Accounts

When comparing high-yield savings accounts, it is imperative to assess various account features, including interest rates, fees, and the quality of customer service provided by financial institutions, as these factors can significantly impact the overall banking experience.

For example, while some accounts may present competitive interest rates, they may also impose substantial monthly maintenance fees that could diminish your earnings. Conversely, certain banks may offer lower interest rates but offset this with the absence of fees and superior customer support, thus facilitating easier account management and access to assistance when required.

Additionally, some institutions may provide unique benefits, such as cash bonuses for new accounts or savings tools that aid in goal setting.

It is prudent to utilize savings account comparison tools, as they enable prospective account holders to evaluate these various features side by side, ultimately guiding them toward a more informed and satisfactory banking decision, facilitated by reputable banks.

How to Open a High-Yield Savings Account: A Guide to Account Opening Process

Establishing a high-yield savings account is a simple process, particularly due to the advancements in digital banking. This evolution significantly enhances account accessibility and simplifies the setup process for customers seeking improved savings options, thereby fostering customer loyalty with financial institutions.

Step-by-Step Guide to the Account Opening Process

To successfully open a high-yield savings account, it is advisable to follow a comprehensive step-by-step guide that incorporates essential online tools for effective account management, thereby ensuring that you maximize the financial products available to you.

- Begin by conducting thorough research to identify institutions that offer the most competitive interest rates and favorable terms, emphasizing financial products and savings account features. Utilize comparison websites that provide current information on various accounts, fees, and interest rates to streamline your options.

- Once you have narrowed down your choices, assess user reviews to evaluate customer satisfaction and the quality of service provided. Ensure that you have all necessary documentation readily available, including identification and proof of address, as this will facilitate a smooth application process, enhancing customer satisfaction.

- When you are prepared to proceed, navigate to the institution’s website, where the online application can typically be completed in just a few straightforward steps, supported by secure online banking.

Additionally, digital resources such as budgeting applications and financial calculators can further assist you in managing your new account effectively and achieving your savings objectives. Banking apps and user-friendly platforms can also ensure easy access to account types with no fees and savings account benefits.

Tips for Maximizing Your Savings

Explore the best savings accounts available this Spring 2025 to take advantage of variable rates and fixed rates, ensuring your savings account ranking stays competitive.

Maximizing savings in a high-yield savings account requires the implementation of effective strategies that align with one’s financial planning objectives, including cash management and the understanding of interest rate trends.

This includes accurate budgeting and the enhancement of financial literacy to facilitate well-considered choices regarding the growth of savings, while considering the inflation impact and tax implications.

Strategies for Increasing Savings and Earning More Interest

Consult financial advisors to explore investment options and saving for retirement, ensuring your savings goals are met.

To enhance savings and optimize interest earnings, it is advisable to implement a variety of savings strategies, such as utilizing a savings calculator to project growth and understanding the impact of compounding interest on financial objectives. Consider rate comparisons and account flexibility for better interest calculations.

Establishing automatic transfers to a savings account can ensure that a portion of one’s income is consistently allocated to savings without requiring deliberate effort. This approach supports consistent saving habits and rewards programs.

Additionally, taking advantage of promotional offers from banks can provide temporary enhancements to savings through elevated interest rates or bonuses. Investigate savings account promotions and saving incentives.

Regularly reviewing account performance permits necessary adjustments, thereby ensuring that strategies remain aligned with financial goals and account maintenance, supported by online account management.

A thorough understanding of how compounding interest functions allows individuals to recognize its potential over time, underscoring the importance of beginning early and maintaining disciplined saving habits. Stay informed with interest rate forecast and economic conditions, benefiting from APY and banking rewards.