A favorable credit score is crucial for obtaining loans, mortgages, and securing advantageous interest rates, as it directly influences your loan approval chances and financial stability. Understanding the concept of a credit score, the various factors that influence it, and recognizing the indicators of a low credit score can enable individuals to take charge of their financial future through credit repair and financial planning. This article discusses practical measures to enhance a low credit score, including reviewing one’s credit report, rectifying errors, settling debts, and utilizing credit judiciously, crucial for effective credit repair. Furthermore, it provides insights on maintaining a healthy credit score over time, offering credit tips and emphasizing responsible borrowing. For those seeking to improve their financial well-being, this article offers valuable information and strategies.

Understanding Credit Scores and Financial Literacy

Understanding credit scores is essential for individuals aiming to manage their personal finances effectively, as it serves as an indicator of creditworthiness and significantly influences the ability to secure financial services, including loans and credit cards.

A credit score is a numerical representation derived from an individual’s credit report, which provides a comprehensive overview of their credit history, encompassing payment history, credit utilization, and accounts maintained with various financial institutions, crucial for creditworthiness assessment and credit modeling.

A thorough comprehension of these factors can facilitate the improvement of one’s credit score and overall financial health, thereby enhancing loan eligibility and obtaining more favorable interest rates.

What is a Credit Score?

A credit score serves as a numerical representation of an individual’s creditworthiness, calculated based on various factors outlined in their credit report, which is maintained by credit agencies. Common scoring models include the FICO score and VantageScore, both of which provide financial institutions with a means to assess the risk associated with lending to a consumer.

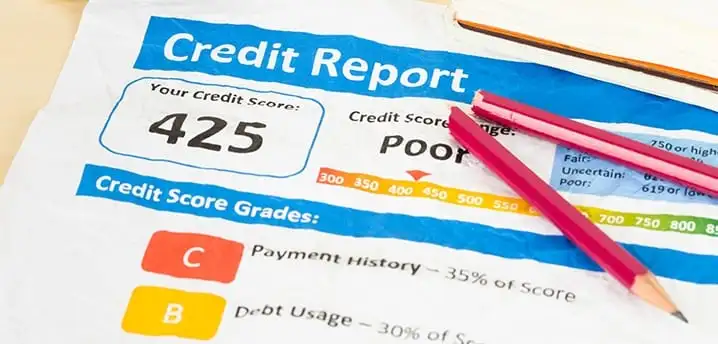

This score typically ranges from 300 to 850, indicating the likelihood of an individual repaying borrowed funds. Understanding the credit score range and several components influence this figure, including:

- Payment history

- Credit utilization ratios

- Length of credit history

- Types of credit utilized, including credit mix and installment loans

- New credit inquiries

A higher score generally reflects responsible financial behaviors, such as timely bill payments and the maintenance of low outstanding debt. In contrast, a lower score may indicate potential risks, leading lenders to impose higher interest rates or to deny credit altogether.

Understanding these elements can significantly enable individuals to manage their financial health more effectively, leveraging credit tools and financial literacy resources.

Factors that Affect Credit Scores and Credit Risk

Several key factors contribute to the determination of an individual’s credit score, including payment history, credit utilization, and the debt-to-income ratio. Together, these elements provide a comprehensive assessment of financial responsibility.

Credit scoring models rigorously evaluate these factors to assess creditworthiness and predict future credit behavior, with late payments and derogatory marks exerting a significant negative influence on the overall score, impacting credit applications and credit policies.

Specifically, payment history constitutes approximately 35% of the total credit score, underscoring the importance of timely bill payments in fostering a positive credit rating. Credit utilization, defined as the ratio of current debt to available credit, should ideally be maintained below 30% to reflect responsible credit management. Furthermore, the debt-to-income ratio assesses an individual’s capacity to manage monthly payments and significantly influences lender perceptions of risk.

To improve these dimensions of credit health, individuals may establish reminders for payment due dates, limit the usage of credit cards, and explore effective debt repayment strategies, such as credit counseling and budgeting:

- the snowball method

- the avalanche method

These proactive measures can considerably enhance overall creditworthiness.

Signs of a Low Credit Score and Financial Management

Identifying a low credit score can be a straightforward process when one is aware of the warning signs to monitor. Key indicators include:

- A high volume of credit inquiries

- A substantial number of negative marks on the credit report

- A considerable frequency of late payments

These factors typically indicate underlying issues in financial management, which can significantly affect an individual’s ability to obtain loans and credit accounts under favorable terms, often necessitating debt management and credit repair strategies.

Identifying a Poor Credit Score

To identify a poor credit score, it is essential to understand the credit score range, which typically classifies scores as excellent, good, fair, or poor. Regular monitoring of your credit report for discrepancies or negative marks is also crucial. A consistent score below 580 is generally regarded as poor and may restrict financial opportunities.

Regularly reviewing your credit report can provide insight into various factors affecting your score, such as late payments, high credit utilization, or inaccurate information, all of which can be disputed with creditors. Utilizing credit monitoring tools can also offer valuable information regarding your financial behavior and notify you of significant changes.

If an individual finds themselves with a low credit score, it is advisable to implement strategies such as:

- Paying down existing debt,

- Ensuring timely payments,

- Maintaining a low credit utilization ratio.

These actions can markedly improve a poor credit score over time, thereby enhancing the likelihood of securing loans or obtaining lower interest rates.

Steps to Improve a Low Credit Score and Enhance Financial Stability

Improving a low credit score requires a systematic approach that begins with reviewing your credit report for any inaccuracies or disputes, using credit monitoring for accountability.

Following this, it is essential to implement effective debt management strategies, which may include credit counseling and budgeting techniques.

By thoroughly understanding your credit history and applying appropriate credit score improvement methods, individuals can gradually enhance their creditworthiness and access more favorable financial opportunities.

Step 1: Check Your Credit Report and Monitor Credit Inquiries

The initial step in improving one’s credit score is to review the credit report, ensuring that all information is accurate and current, as inaccuracies can result in unnecessary credit inquiries and adversely impact the score. Regular monitoring of the credit report facilitates the identification of errors, allowing for timely disputes.

To obtain a credit report, individuals may request documents from the three primary credit reporting agencies: Experian, TransUnion, and Equifax. Each agency provides a complimentary annual report, accessible through the official website AnnualCreditReport.com.

When evaluating the report, it is essential to examine it for discrepancies, such as incorrect personal information, unfamiliar accounts, or inaccurate late payments that could harm one’s creditworthiness. Should any inaccuracies be identified, individuals should compile supporting documentation and contact the appropriate credit bureau to initiate a dispute.

This proactive approach not only helps maintain a healthy credit profile but may also contribute to an improvement in the credit score over time.

Step 2: Address Any Errors and Dispute Inaccuracies

Addressing any errors identified in one’s credit report is essential for improving a credit score, as inaccuracies can result in derogatory marks that negatively impact creditworthiness. Initiating a dispute process with credit agencies can assist in rectifying these mistakes and enhancing the overall credit profile.

To commence this process, individuals should obtain copies of their credit reports from all three major credit bureaus and meticulously review them for discrepancies. If an error is discovered, it is important to gather supporting documentation to substantiate the claim before contacting the relevant credit bureau. Prompt action is crucial, as unresolved inaccuracies can lead to higher interest rates and adversely affect loan approvals.

Correcting these errors not only restores accuracy but can also result in a substantial improvement in one’s credit score, which in turn facilitates access to better financial opportunities and more favorable lending terms.

Step 3: Pay Off Outstanding Debts and Utilize Debt Settlement

Paying off outstanding debts is an essential step toward improving one’s credit score, as it has a positive impact on both payment history and credit utilization ratio—two critical factors in creditworthiness assessments. Developing a strategic debt management plan can lead to significant financial enhancements over time.

By prioritizing high-interest debts, individuals can reduce the total amount paid over time, thus freeing up more resources for savings or future investments. Establishing realistic payment plans that align with personal budgets is also fundamental, as it facilitates manageable and consistent payments, alleviating feelings of being overwhelmed.

Consolidating multiple debts into a single loan can simplify financial management and potentially lower interest rates, making it easier for individuals to remain on track. These strategies not only offer immediate debt relief but also contribute to a healthier credit profile, ultimately paving the way for improved loan options in the future.

Step 4: Use Credit Responsibly

Using credit responsibly involves maintaining a low credit utilization ratio and making timely payments on credit accounts, which significantly contributes to the improvement of one’s overall credit score. Establishing a habit of responsible borrowing, along with utilizing secured credit cards, can prevent negative marks on one’s credit history and promote long-term financial stability.

By regularly monitoring spending and remaining aware of credit limits, individuals can avoid the dangers associated with high debt and ensure that they do not engage in overspending. Utilizing credit score monitoring tools can aid in this process.

It is essential to create a budget that accommodates necessary expenses while allocating a portion of income for credit card payments. Additionally, setting up alerts for due dates can help prevent late fees and protect one’s credit rating. Implementing repayment plans for outstanding balances is also advisable.

Furthermore, understanding the terms associated with each credit card, including unique interest rates and reward systems, enables consumers to make informed financial decisions that ultimately support a healthier financial future.

Maintaining a Good Credit Score

Maintaining a favorable credit score necessitates continuous diligence and financial responsibility, which includes regular credit tracking and adherence to effective budgeting practices. Engaging in financial workshops is beneficial for ongoing credit education.

The implementation of prudent credit strategies, such as maintaining a low credit utilization ratio, utilizing credit score improvement strategies, and minimizing unnecessary credit inquiries, is essential for ensuring robust financial health and sustaining a high credit score.

Tips for Maintaining a High Credit Score

To maintain a high credit score, it is essential to adopt sound financial habits, including timely payments, effective budgeting, and diligent credit monitoring. Implementing these credit strategies helps mitigate risks associated with identity theft and late payments, ultimately supporting one’s financial objectives. Utilizing credit boosts and understanding credit score factors are also crucial for success.

Plus these practices, establishing a consistent routine for reviewing credit reports can provide valuable insights into spending patterns and outstanding debts. Regularly checking credit scores can alert individuals to any discrepancies or potential threats that may arise, enabling prompt corrective action.

It is crucial to keep credit utilization below 30%, as this reflects responsible credit management. Automating payments and setting up reminders can further enhance the likelihood of maintaining timely payments. Leveraging credit apps can simplify these tasks.

By actively engaging in these strategies and demonstrating financial discipline, individuals are likely to see improvements in their credit scores, thereby paving the way for more favorable loan terms and lower interest rates. This aligns with achieving long-term financial goals.

Frequently Asked Questions

What is considered a low credit score?

A credit score below 580 is generally considered a low credit score. This can vary among different credit reporting agencies.

How can I find out my credit score?

You can request a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once a year. This will include your credit score.

What are some steps I can take to improve my credit score?

Some steps you can take include paying your bills on time, keeping your credit card balances low, and disputing any errors on your credit report.

Can I fix my credit score on my own?

Yes, you can fix your credit score on your own. It may take time and effort, but it is possible to improve your credit score by following a step-by-step guide.

How long does it take to improve a low credit score?

The time it takes to improve a low credit score can vary depending on your specific situation. It may take a few months or even a year to see significant improvements.

Is it necessary to hire a credit repair company to fix my credit score?

No, it is not necessary to hire a credit repair company. You can follow a step-by-step guide and take the necessary steps to improve your credit score on your own. Understanding credit repair myths is vital for self-management.