Creating a monthly budget represents a significant step toward achieving financial stability and success. This guide outlines seven straightforward steps designed to assist individuals in understanding their income, tracking their expenses, and establishing achievable financial goals. Readers will learn how to develop a customized budget plan that prioritizes their essential needs while also preparing for unforeseen costs. Whether one is new to budgeting or seeking to enhance their existing strategy, these steps will provide the necessary tools for fostering a more secure financial future.

Why You Need a Monthly Budget

Establishing a monthly budget is an essential component of effective financial management. It enables individuals to allocate their income efficiently, monitor expenses, and ultimately achieve their financial objectives.

By formulating a comprehensive spending plan, one gains valuable insight into cash flow, facilitating the effective management of both fixed and variable expenses. This practice also promotes financial literacy, thereby creating a solid foundation for long-term financial planning.

Additionally, a budget serves as a powerful instrument for evaluating financial habits and making informed decisions that align with one’s aspirations for financial independence.

The Importance of Financial Planning

Financial planning serves as the foundation for effective budget creation and is essential for achieving long-term financial success. This process involves assessing current income, estimating future needs, and establishing clear financial goals that guide the budgeting process.

A well-structured financial plan enables individuals to categorize expenses and identify areas for potential savings, ensuring that resources are allocated appropriately and responsible spending is prioritized. By integrating budgeting strategies within financial planning, individuals can proactively respond to economic fluctuations and attain greater financial stability.

Understanding the importance of financial planning not only enhances individual budgeting practices but also facilitates improved decision-making regarding investments and savings. Establishing specific, measurable financial goals allows individuals to monitor their progress and maintain motivation.

Diligently tracking income and expenses aids in recognizing spending patterns, which can lead to more informed financial choices.

Individuals are encouraged to utilize tools such as budgeting applications or spreadsheets to streamline their tracking processes. Regularly reviewing and adjusting financial plans is crucial to ensure alignment with changing life circumstances, thereby fostering a sense of control over their financial situation.

Step 1: Determine Your Income

The initial step in developing a successful monthly budget involves determining one’s income, which serves as the cornerstone for all financial planning endeavors.

This process requires the identification of all income sources, including salaries, supplementary work, rental income, and any other revenue streams.

By accurately calculating the total monthly income, an individual can formulate a realistic spending plan that facilitates effective resource allocation and prioritization of expenses.

A comprehensive understanding of income is essential for establishing achievable savings objectives and ensuring financial accountability throughout the budgeting process.

Identifying All Sources of Income

Identifying all sources of income is a fundamental aspect of the budgeting process, as it establishes the foundation for effective financial tracking and management. This identification encompasses not only primary salary but also additional income sources such as freelance work, dividends, and interest from savings.

Recognizing these various streams enables individuals to gain a comprehensive understanding of their financial landscape. For instance, income derived from side projects or rental properties should be documented meticulously using tools such as spreadsheets or specialized financial applications.

Passive income from investments, which may fluctuate, necessitates regular monitoring to ensure accuracy.

It is imperative for effective budgeting that every dollar earned is accounted for; this practice not only facilitates informed financial planning but also guides strategies for savings, debt repayment, and investment opportunities.

By maintaining organization and regularly reviewing income sources, individuals can confidently adapt their budget in response to changing financial circumstances.

Step 2: List Your Expenses

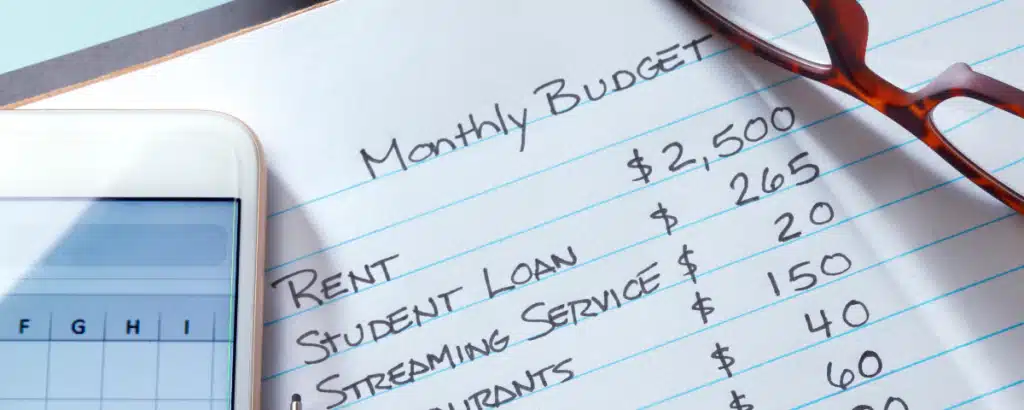

Listing expenses constitutes the second step in the budgeting process and is essential for comprehending monthly financial outflows.

By categorizing expenses into fixed and variable categories, individuals can gain clarity regarding their financial obligations and discretionary spending.

Fixed expenses, such as rent or mortgage payments, remain consistent, whereas variable expenses may vary from month to month. This thorough analysis of expenses is critical for effective budgeting, as it facilitates improved cash flow management and identifies potential areas for cost reduction, ultimately aiding in the achievement of savings objectives.

Tracking and Categorizing Expenses

Tracking and categorizing expenses is a fundamental step in effectively managing one’s finances, as it provides valuable insights into spending habits and informs budgeting strategies.

In the contemporary digital landscape, various methods are available to streamline this process. For example, utilizing a budget worksheet can facilitate the capture of all expenses at a glance, while advanced budgeting applications offer features such as automatic categorization and real-time notifications.

These tools not only enhance efficiency but also minimize the risk of oversight. By categorizing expenses into essential groups such as:

- groceries

- utilities

- entertainment

Individuals can more easily identify patterns that inform their spending limits.

Regularly reviewing these categories can help identify unnecessary expenditures, thereby promoting a proactive approach to financial management.

Step 3: Set Financial Goals

Establishing financial goals is a critical component of the budgeting process that can greatly influence overall financial success. By defining both short-term and long-term objectives, individuals create a structured roadmap that facilitates budget implementation and resource allocation.

These objectives may encompass:

- Building an emergency fund

- Saving for significant purchases

- Planning for retirement

Clearly articulated savings goals encourage individuals to maintain focus and motivation as they monitor their progress, ultimately helping with the attainment of desired financial outcomes and fostering financial discipline over time.

Defining Short and Long-Term Goals

Defining both short-term and long-term financial goals is essential for effective budgeting and responsible financial management. Short-term goals, such as saving for a vacation or paying off credit card debt, typically have a time frame of one year or less. In contrast, long-term goals, such as retirement savings or purchasing a home, extend over multiple years.

Establishing clear and actionable financial objectives informs the budgeting process and helps maintain budget discipline, ensuring efficient allocation of funds to meet these goals.

By distinguishing between these two types of goals, individuals can prioritize their spending and savings strategies more effectively. Short-term financial objectives often concentrate on immediate needs and desires, while long-term goals necessitate a broader vision and generally involve larger amounts of money.

To set realistic objectives, it is important to consider personal circumstances, income stability, and potential future obligations. Incorporating these goals into a sustainable budget entails regularly reviewing progress and making necessary adjustments, thereby allowing for flexibility and responsiveness in an ever-changing financial landscape.

Step 4: Create a Budget Plan

Developing a budget plan is a crucial component of the budgeting process that enables individuals to allocate their income effectively and prioritize their expenses. This process entails a thorough analysis of one’s financial situation, considering both fixed and variable costs, while aligning expenses with overarching financial goals.

A well-structured budget plan not only ensures the fulfillment of immediate financial obligations but also promotes savings and responsible spending habits. Successfully implementing the budget necessitates discipline and consistency; however, the resultant benefits of enhanced financial stability and economic freedom are well worth the effort.

Allocating Funds and Prioritizing Expenses

Allocating funds and prioritizing expenses are essential components of a successful budgeting plan, enabling individuals to make informed financial decisions aligned with their goals and obligations. This process involves assessing income against expenses to allocate funds appropriately across various categories, ensuring that the most pressing financial responsibilities are addressed first.

Effective budgeting strategies, such as the 50/30/20 rule, can facilitate this allocation process by helping individuals balance essential needs with discretionary spending and savings. Prioritizing expenses also enhances expense management, fostering greater financial accountability.

To further improve budgeting skills, consider implementing the zero-based budgeting approach, wherein every dollar is assigned a specific purpose, thus minimizing waste. This method promotes increased awareness of spending habits and encourages deliberate decision-making.

Regularly reviewing and adjusting the budget in response to changing circumstances—such as a new employment opportunity, unexpected expenses, or the achievement of a financial milestone—ensures alignment with overarching financial goals. For example, if saving for a vacation is a priority, reassessing discretionary spending on entertainment can help free up essential funds.

By adopting these actionable insights, individuals can enhance their financial literacy and establish a more effective management strategy for their resources.

Step 5: Stick to Your Budget

Adhering to a budget is critical for achieving financial goals and maintaining discipline throughout the budgeting process. This requires a commitment to proactive money management, ensuring adherence to the established spending plan while resisting the allure of impulsive purchases.

Implementing effective budgeting strategies, such as setting reminders, regularly tracking expenses, and making necessary adjustments to the budget, can substantially enhance the likelihood of remaining on course.

By cultivating responsible spending habits, individuals can develop a healthy financial mindset and confidently work towards their long-term objectives.

Tips for Staying on Track

Maintaining adherence to a budget necessitates consistent effort and the implementation of effective budgeting strategies that enhance financial accountability. Regular expense tracking is essential for monitoring spending habits and identifying any deviations from the established budget.

The use of budgeting software or applications can facilitate this process, providing clarity regarding one’s financial status. Establishing periodic budget reviews enables individuals to assess their progress and make necessary adjustments to ensure alignment with financial objectives.

Allocating time each week for a comprehensive review of financial activities allows for an in-depth evaluation of effective strategies and areas requiring improvement. This practice not only cultivates mindfulness regarding expenditures but also aids in the recognition of spending patterns over time.

Leveraging features available in financial management tools, such as alerts for overspending or progress tracking towards savings goals, can serve as valuable motivators, fostering accountability among individuals.

Participating in support groups or budgeting communities can offer encouragement and facilitate the exchange of insights that refine budgeting strategies, ultimately contributing to the development of healthier financial habits and promoting long-term financial stability.

Step 6: Review and Adjust Your Budget

Reviewing and adjusting the budget is a crucial component of the budgeting process, allowing individuals and organizations to respond effectively to changes in their financial circumstances and optimize their financial tracking efforts.

Regular evaluations facilitate the assessment of spending patterns, the identification of areas for improvement, and the implementation of necessary budget adjustments to enhance overall financial management. This iterative process fosters financial awareness and accountability, enabling more effective navigation of budgeting challenges and alignment with financial objectives.

It is imperative to consider the budget as a dynamic tool rather than a static document.

Periodic Evaluations and Modifications

Conducting periodic evaluations and adjustments of one’s budget is essential for effective financial management and for adapting to changing financial circumstances. These assessments provide an opportunity to review financial performance, compare actual expenditures against budgeted amounts, and identify any discrepancies that may require modification.

By recognizing budgeting challenges early, individuals can implement proactive changes to align their spending with financial goals, thus maintaining control over their financial planning. This flexible approach enhances the understanding of cash flow and promotes overall financial accountability.

For instance, unexpected expenses such as car repairs or medical bills can disrupt even the most meticulously planned budgets, necessitating a reassessment of financial priorities. A sudden increase in utility costs during the summer months may require reallocating funds from discretionary categories.

Effective strategies include:

- Setting aside emergency funds for such unexpected scenarios

- Tracking expenditure patterns to identify areas that need attention

Additionally, if an individual receives a salary increase, it may be prudent to adjust their budget to allocate more towards savings or investments, thereby enhancing financial stability.

Regularly revisiting and modifying the budget ensures that it remains relevant and attainable, enableing individuals to take control of their financial future.

Step 7: Plan for Unexpected Expenses

Planning for unexpected expenses is a crucial component of budgeting that significantly contributes to financial stability and long-term security.

Unforeseen costs, such as medical bills or car repairs, can disrupt even the most meticulously prepared budget, underscoring the importance of having a strategy in place to address these challenges.

Establishing an emergency fund represents a proactive measure to protect against financial surprises, offering a financial cushion that enables individuals to uphold their budgetary discipline while managing unexpected expenses.

This foresight is instrumental in achieving financial objectives and improving overall expense management.

Building an Emergency Fund

Establishing an emergency fund is a fundamental component of effective financial planning that equips individuals to handle unexpected expenses while enhancing their overall financial security. An emergency fund serves as a financial safety net, enabling the coverage of unforeseen costs without disrupting one’s budget or necessitating the use of debt.

It is generally advisable to save an amount equivalent to three to six months’ worth of living expenses within this fund, contributing to it incrementally as part of a comprehensive savings strategy. By prioritizing this fund within a budget, individuals can maintain peace of mind and ensure that their financial management strategies remain robust in the face of life’s uncertainties.

To effectively establish this fund, it is prudent to begin by evaluating monthly expenses, including essential costs such as rent, utilities, groceries, and transportation.

After determining a clear figure, one should set realistic savings goals, breaking them down into manageable monthly amounts. Automating savings by creating a separate account for the emergency fund, preferably one that accrues interest, can facilitate the growth of savings over time.

Additionally, it is important to regularly review the fund to ensure it aligns with current living expenses and to adjust contributions as necessary, particularly following significant life changes.

This proactive approach not only fosters financial resilience but also nurtures long-term habits that contribute to enhanced overall financial health.

Frequently Asked Questions

What are the benefits of creating a monthly budget?

Creating a monthly budget helps you track your expenses, plan for future purchases, save money, and reach your financial goals.

What are the 7 simple steps to create your first monthly budget?

1. Determine your monthly income 2. List all your expenses 3. Categorize your expenses 4. Set financial goals 5. Allocate a budget for each category 6. Track your spending 7. Adjust and review your budget regularly

How do I calculate my monthly income?

To calculate your monthly income, add up all sources of income such as salary, freelance work, investments, and any other sources of income you receive in a month.

What expenses should I include in my budget?

Include all your fixed expenses such as rent, utilities, and loan payments, as well as variable expenses like groceries, entertainment, and transportation costs.

Why is it important to set financial goals when creating a budget?

Setting financial goals gives you a clear direction and motivation to stick to your budget. It also allows you to prioritize your spending in order to achieve your goals.

How often should I review my budget?

It is recommended to review your budget at least once a month to track your progress and make any necessary adjustments. However, it is also helpful to do a quarterly or yearly review to assess your overall financial health.